If you’re relatively new to real estate investing, the lingo can be confusing. Two key terms you should know when comparing investment options are AAR and IRR.

What is Annual Average Return (AAR)?

The annual average return, or AAR, is a formula used to measure the performance of an investment over a period of time. To calculate AAR, you simply take the annual cash-on-cash returns for each year of an investment and average them.

A quick refresher on calculating cash-on-cash returns: You simply divide the cash out of an investment each year (your profits after operating expenses and mortgage payments) and divide it by your initial cash into the investment (your initial equity).

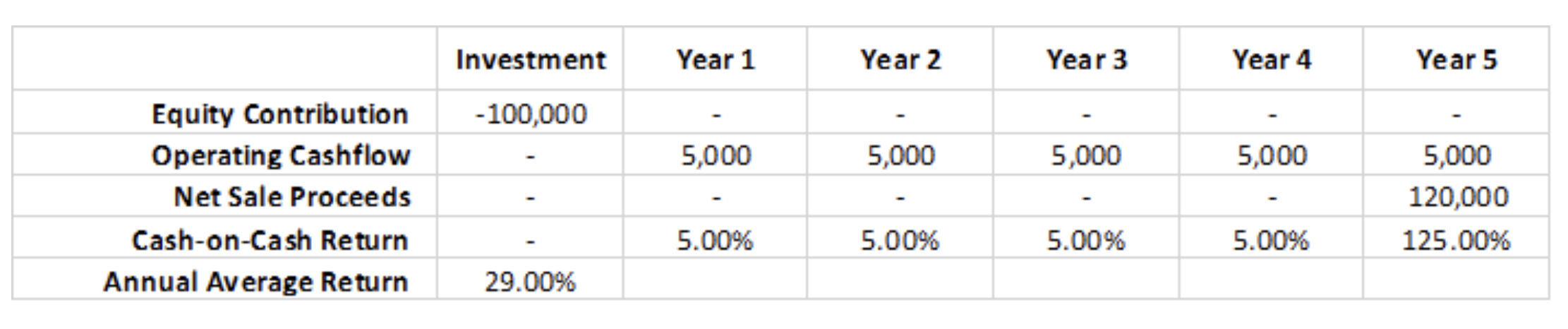

Here is an example of what cash-on-cash returns and the resulting Average Annual Return would look like for a hypothetical investment:

The Average Annual Return shown above takes the sum total of each year’s cash-on-cash return (cumulatively 145 percent) and divides it by the holding period of five years, resulting in an AAR of 29 percent.

How Does AAR Differ from the Internal Rate of Return (IRR)?

While also used to measure the performance of an investment, the Internal Rate of Return, or IRR, is calculated differently than AAR. The IRR is the annual rate of growth an investment is expected to generate. Unlike AAR, the Internal Rate of Return takes into account the time value of money, or the understanding that you are going to reinvest your money to avoid losing its value to inflation.

In the hypothetical investment shown above, your Internal Rate of Return would only be 8.4 percent—far below the annual average return of 29.0 percent!

Which is Preferred, AAR or IRR?

The core issue with using AAR as an investment metric is that it does not account for time value of money. A dollar today is generally worth more than a dollar a year from now. Inflation depreciates the value of that dollar. Plus, if I invest that dollar today, I’ll have earned a return on that dollar a year from now.

Some real estate syndicators present their returns based on the Average Annual Return. This metric looks the same as the Internal Rate of Return at first glance since both are often shown as double-digit percentage returns. So be careful if you are evaluating an investment that is presented with X percent AAR.

Ask the person presenting the investment what the Internal Rate of Return is for that investment so you can compare it to other investment opportunities in an apples-to-apples fashion.

Why Invest with Hearthfire?

Our success is built on trust—we want to help you understand your investment options. Every step of the way, we’re here to guide you through creating a strong, secure portfolio that delivers great returns.

Ready to take your money and make it worth a lot more?

Learn more about syndication investing, or contact us today to connect directly with a real estate syndication expert.